Investing in Chromium Stocks: A Comprehensive Guide for 2024

Understanding Chromium and Its Significance

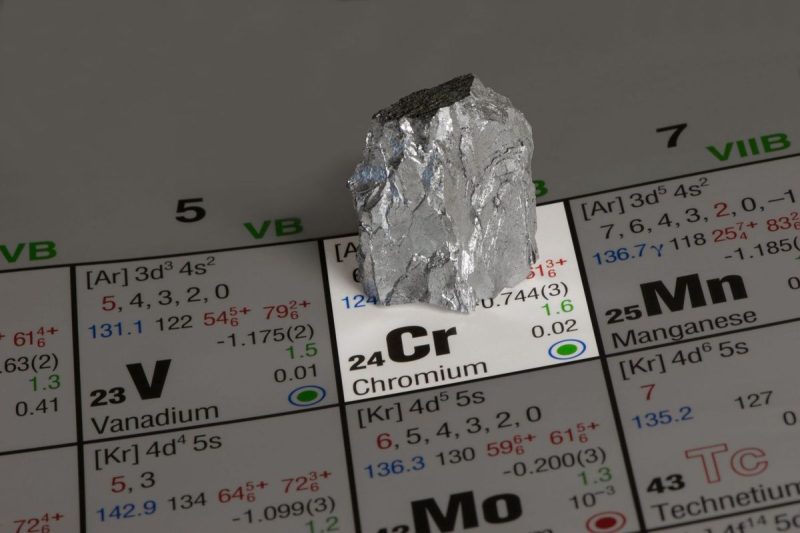

Chromium is a crucial industrial metal widely used in the manufacturing of stainless steel, alloys, and other products in various industries. It possesses valuable properties such as corrosion resistance, hardness, and heat resistance, making it a sought-after material for industrial applications.

Why Invest in Chromium Stocks?

Investing in chromium stocks can offer lucrative opportunities for investors due to the increasing demand for stainless steel and other chromium-based products across the globe. As the global economy continues to recover and grow, the demand for chromium is expected to rise, presenting an attractive investment prospect for those looking to diversify their portfolios.

Factors to Consider Before Investing in Chromium Stocks

Before diving into the world of chromium stocks, it is essential to consider several key factors to make informed investment decisions:

1. Market Trends and Demand: Analyzing market trends and demand for chromium-related products can provide valuable insights into the growth potential of chromium stocks.

2. Industry Performance: Understanding the performance of the stainless steel and alloy industries, which are major consumers of chromium, can help gauge the future demand for chromium stocks.

3. Global Economic Outlook: Keeping abreast of the global economic outlook and industrial activities in major economies can influence the demand for chromium and, in turn, its stocks.

4. Company Fundamentals: Evaluating the financial health, growth prospects, and competitive positioning of chromium-producing companies is crucial for selecting promising investment opportunities.

5. Geopolitical Factors: Considering geopolitical factors, such as trade policies, mining regulations, and supply chain disruptions, can impact the production and pricing of chromium stocks.

Strategies for Investing in Chromium Stocks

Investors can adopt various strategies to maximize their returns when investing in chromium stocks:

1. Diversification: Diversifying your investment portfolio with a mix of chromium stocks can help spread risks and capture opportunities in different segments of the industry.

2. Long-Term Investment: Taking a long-term perspective when investing in chromium stocks can align with the growth trajectory of the industry and yield substantial returns over time.

3. Monitoring Market Trends: Staying informed about market trends, technological advancements, and regulatory changes can help investors make timely decisions and adjust their investment strategies.

4. Risk Management: Implementing risk management techniques, such as setting stop-loss orders and maintaining a diversified portfolio, can protect your investments from market volatility.

5. Seek Professional Advice: Consulting with financial advisors or industry experts can provide valuable insights and guidance when navigating the complexities of the chromium market.

In Conclusion

Investing in chromium stocks can be a rewarding venture for investors seeking exposure to the industrial metal sector. By understanding the dynamics of the chromium market, conducting thorough research, and adopting prudent investment strategies, individuals can capitalize on the growth opportunities presented by this essential industrial metal.