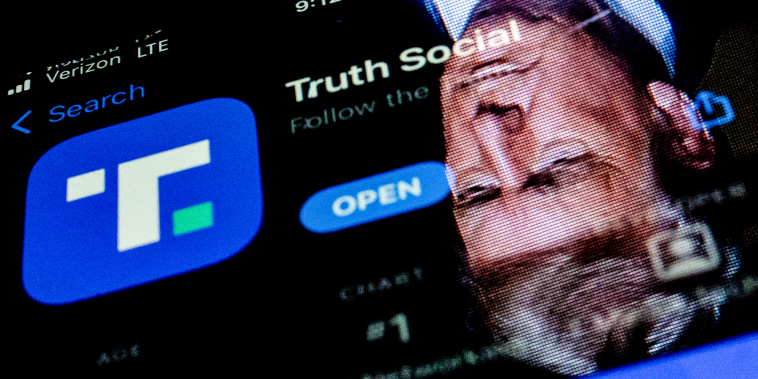

In a recent turn of events, media shares linked to former President Donald J. Trump experienced a significant decline following a public filing revealing plans to issue additional DJT stock. This move by the company has sparked major interest and concern in both investor circles and the broader financial community.

The decision to increase the issuance of DJT stock has raised various questions and speculations regarding the company’s future trajectory. Investors are closely monitoring the implications of this move on the company’s stock price and overall performance in the market.

The news of additional DJT stock issuance comes at a time when the media landscape is undergoing rapid transformation and facing unprecedented challenges. With increased competition from digital platforms and changing consumer preferences, traditional media companies are striving to adapt and stay relevant in the evolving landscape.

The impact of this development on Trump Media’s market value and investor confidence remains uncertain. Some industry experts believe that the issuance of additional stock could dilute the value of existing shares and create downward pressure on the company’s stock price in the short term.

Moreover, the public filing has also raised questions about the strategic direction of Trump Media and its ability to navigate the complex dynamics of the media industry. Investors are keenly watching how the company plans to use the proceeds from the additional stock issuance and whether it can effectively capitalize on emerging opportunities in the market.

The decline in media shares following the announcement underscores the importance of transparent communication and strategic planning in the corporate world. Companies must strike a balance between innovation and stability to ensure sustained growth and investor confidence in an increasingly competitive landscape.

As the situation continues to unfold, investors, analysts, and industry observers will be closely monitoring Trump Media’s next steps and how the company navigates the challenges and opportunities in the media industry. The coming months will be crucial in determining the long-term implications of the additional DJT stock issuance on the company’s performance and market position.