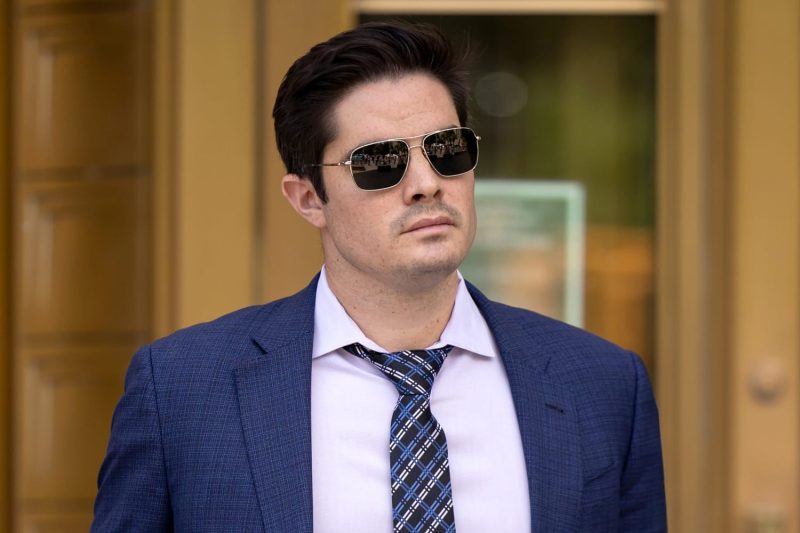

In a surprising turn of events, a former FTX executive who cooperated with authorities against Sam Bankman-Fried, the founder and CEO of FTX, has been sentenced to 7.5 years in prison for his involvement in a complex financial scheme. This development sheds light on the intricate world of cryptocurrency trading platforms and the consequences that come with engaging in illegal activities within this space.

The unnamed executive’s decision to turn on his former colleague, Sam Bankman-Fried, underscores the pressure individuals face when dealing with legal proceedings tied to fraudulent activities. By offering information to authorities, he struck a deal to reduce his sentence, a tactic commonly used in cases involving high-profile individuals where individuals often face the dilemma of cooperating with the authorities or facing severe consequences on their own.

The case also raises questions about the culture and ethics within the cryptocurrency industry. As digital assets become more mainstream, regulatory scrutiny and legal enforcement are increasing, prompting individuals and companies to navigate carefully to avoid legal pitfalls. The actions of the former FTX executive demonstrate the potential risks of operating within a largely unregulated sector and highlight the importance of compliance and ethical conduct in financial dealings.

Furthermore, the length of the sentence – 7.5 years – serves as a stark reminder of the serious repercussions faced by those who engage in illegal activities, particularly in the cryptocurrency sector. Prosecutors are keen on setting examples to deter others from committing similar offenses, and the severity of the punishment reflects the seriousness with which the legal system approaches financial crimes.

Sam Bankman-Fried’s involvement in this case adds another layer of complexity to the narrative, as his stature in the cryptocurrency world amplifies the impact of the situation. As the founder of FTX, one of the largest and most renowned cryptocurrency exchanges, his association with the former executive’s criminal activities could potentially tarnish the reputation of the platform and raise concerns among users and investors.

Overall, this sentencing highlights the intricate web of legal and ethical considerations that individuals and companies in the cryptocurrency industry must navigate. As the sector continues to evolve and attract more attention, it becomes increasingly crucial for stakeholders to uphold high standards of integrity, transparency, and compliance to safeguard against legal repercussions and maintain the trust of their clients and the broader community.