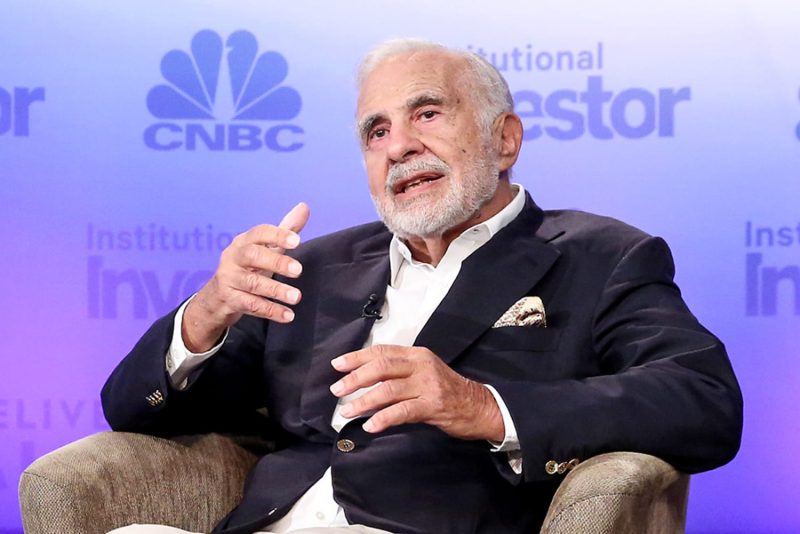

In a regulatory move that has sent shockwaves through the financial world, the U.S. Securities and Exchange Commission (SEC) has charged renowned investor Carl Icahn with concealing billions of dollars worth of stock pledges. The allegations, detailed in a recent SEC filing, accuse Icahn of bypassing reporting requirements that are mandated under federal securities laws. This revelation has raised serious questions about the practices of even the most esteemed figures in the investment community.

Carl Icahn, a billionaire activist investor known for his outspoken and aggressive investment strategies, has long been a prominent figure in the financial arena. With a reputation for shaking up boardrooms and driving significant changes in the companies he invests in, Icahn’s influence is substantial. However, the SEC’s allegations paint a troubling picture of his financial dealings.

According to the SEC filing, Icahn failed to disclose millions of shares used as collateral for margin loans, a practice that is required to be reported to the SEC. By withholding this critical information, Icahn allegedly misled investors and manipulated the market by creating a false impression of his investment activities. Such actions not only violate legal requirements but also undermine transparency and integrity in the financial markets.

This case serves as a stark reminder of the importance of regulatory compliance and transparency in the investment world. As investors and market participants rely on accurate and timely information to make informed decisions, any attempt to manipulate or conceal such information can have far-reaching consequences. The charges against Icahn highlight the need for stringent oversight and enforcement to ensure fair and orderly markets.

Beyond the immediate implications for Carl Icahn, this case raises broader questions about the culture of accountability and transparency in the financial industry. While high-profile cases like this one attract significant attention, they also shed light on the need for ongoing vigilance and scrutiny to prevent similar violations in the future. Regulatory bodies such as the SEC play a crucial role in upholding the integrity of the financial markets and protecting investors from potential misconduct.

In response to the charges, Carl Icahn has denied any wrongdoing and vowed to vigorously defend himself against the SEC’s allegations. As the legal proceedings unfold, the outcome of this case will have significant implications not only for Icahn himself but also for the broader investment community. Regardless of the final resolution, this case serves as a cautionary tale about the risks of non-compliance and the importance of transparency in the financial world.