In the recent case of a cryptocurrency pig butchering scam that wreaked havoc on a Kansas bank and led to the imprisonment of the former CEO for 24 years, the intricate web of deceit and financial manipulation highlights the vulnerabilities of the banking system to emerging digital currencies and fraudulent schemes. The story serves as a cautionary tale for institutions and individuals alike, urging heightened vigilance and due diligence in the face of evolving financial landscapes.

At the heart of the scandal was the deceptive promise of yield farming through the development of a novel digital currency backed by unconventional assets – in this case, virtual shares in a pig butchering business. The scheme preyed on investors’ greed and willingness to embrace unorthodox investment opportunities, ultimately leaving behind a trail of financial ruin and shattered trust.

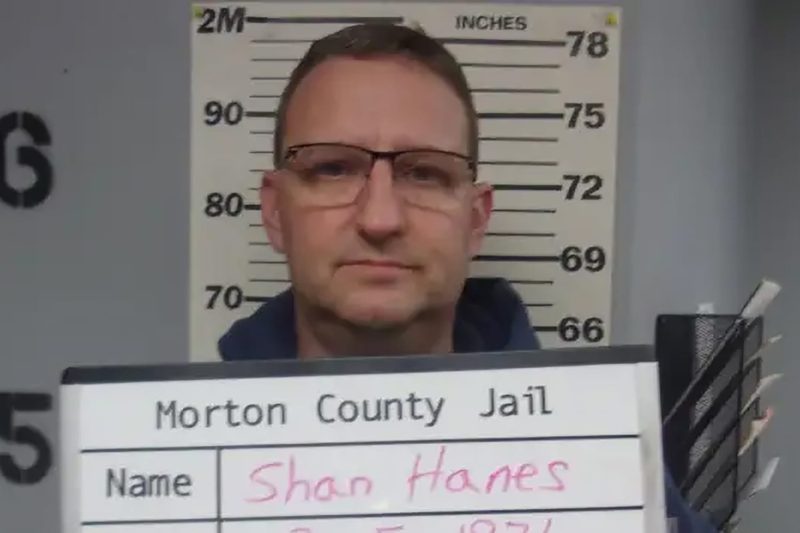

Perhaps most alarming was the complicity of top executives, including the bank’s CEO, in perpetuating the fraud and leveraging their positions of authority to solicit unsuspecting clients. The CEO’s subsequent conviction and lengthy prison sentence underscore the severity of the crimes committed and serve as a stark reminder of the consequences of breaching fiduciary duty and engaging in illicit financial practices.

As the financial landscape continues to evolve with the rise of cryptocurrencies and decentralized finance, regulatory bodies and industry stakeholders must remain vigilant in detecting and preventing fraudulent activities that threaten the stability and integrity of the banking system. Heightened transparency, robust compliance measures, and enhanced due diligence are essential in safeguarding against similar scams and protecting investors from falling victim to unscrupulous actors.

In the aftermath of the cryptocurrency pig butchering scam that rocked the Kansas bank and led to the incarceration of its former CEO, the financial industry must heed the lessons learned and fortify its defenses against emerging threats and fraudulent schemes. Only through collective vigilance and a commitment to ethical and transparent financial practices can the sector maintain its integrity and safeguard the interests of investors and clients alike.