AlphaFold Stock: A Beginner’s Guide to Investing in Artificial Intelligence

AlphaFold is a buzzword in the realm of artificial intelligence (AI) and investment. Since its acquisition by Google’s parent company, Alphabet, AlphaFold has been making headlines for its groundbreaking deep learning technology that has shown remarkable advancements in the field of protein structure prediction.

Investing in AlphaFold stock can be an exciting opportunity for those looking to capitalize on the potential of AI technology. However, before diving headfirst into the stock market, it’s important for investors to understand the basics of AlphaFold, its applications, and the factors to consider when investing in the company.

Understanding AlphaFold and Its Technology

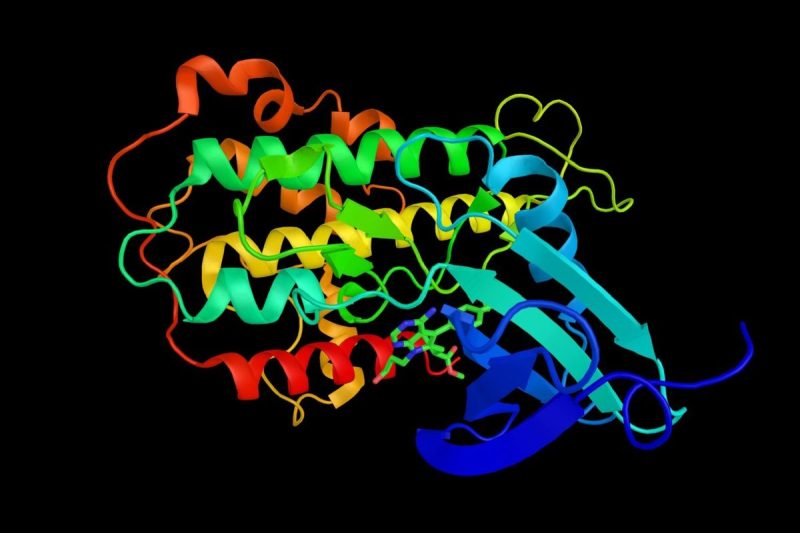

AlphaFold is an AI system developed by DeepMind, a subsidiary of Alphabet. The system utilizes deep learning algorithms to predict the 3D structure of a given protein based solely on its amino acid sequence. This groundbreaking technology has the potential to revolutionize drug discovery, protein engineering, and various other fields within the life sciences.

The technology behind AlphaFold involves neural networks trained on vast datasets of protein structures to predict how amino acids fold into complex 3D shapes. By accurately predicting the structure of proteins, AlphaFold can help researchers better understand the function and interactions of these biological molecules, leading to new breakthroughs in medicine, agriculture, and biotechnology.

Applications and Market Potential

The potential applications of AlphaFold are vast and diverse. By accurately predicting protein structures, the technology can accelerate drug discovery by identifying potential drug targets and designing more effective pharmaceuticals. It can also aid in understanding genetic disorders, developing new crop varieties, and optimizing industrial enzymes.

In terms of market potential, the global AI in healthcare market is expected to reach $45.2 billion by 2026, driven by the increasing adoption of AI technologies in drug discovery, diagnostic imaging, and personalized medicine. AlphaFold’s unique capabilities in protein structure prediction position it as a key player in this rapidly growing market.

Factors to Consider When Investing in AlphaFold Stock

Before investing in AlphaFold stock, investors should consider a few key factors to make informed decisions. Firstly, it’s important to understand the competitive landscape and the barriers to entry in the AI and healthcare sectors. As a subsidiary of Alphabet, AlphaFold benefits from the resources and expertise of one of the world’s leading tech companies, giving it a competitive edge over other players in the market.

Additionally, investors should assess the scalability and commercialization potential of AlphaFold’s technology. The ability to translate scientific breakthroughs into marketable products and services is essential for long-term growth and profitability. By analyzing the company’s partnerships, intellectual property portfolio, and revenue streams, investors can gauge the potential for future success.

Moreover, keeping an eye on regulatory developments and industry trends is crucial for evaluating the risks and opportunities associated with investing in AlphaFold stock. As AI technologies continue to evolve, regulatory frameworks may impact the adoption and deployment of AI solutions in healthcare and other industries.

In conclusion, investing in AlphaFold stock can be a strategic move for investors looking to capitalize on the transformative potential of AI in the healthcare sector. By understanding the technology, applications, market potential, and key factors to consider, investors can make informed decisions to navigate the dynamic landscape of AI investments. As always, conducting thorough research and seeking advice from financial professionals is recommended before making any investment decisions.